Self Employed

Call our team on: 01332 300 300

Tailored mortgages for entrepreneurs

Do you own your own business and are struggling to get a mortgage? We have decades of experience finding the best mortgage deals for the self-employed.

There are now more self-employed people than ever and with the added flexibility and control it can provide, we have no doubt this will keep rising. With complex income streams and different lenders setting the bar higher, our clients can find it difficult to get mortgages approved by lenders.

Here at Mortgage and Finance Arena, we’re here to help every step of the way and find you the best self-employed mortgage lender for your situation. We have access to a variety of mortgage providers, so you’ll soon be in the home of your dreams.

Please remember, as a mortgage is secured against your home, it could be repossessed if you do not keep up the mortgage repayments.

Working with thousands of lenders to find the right fit…

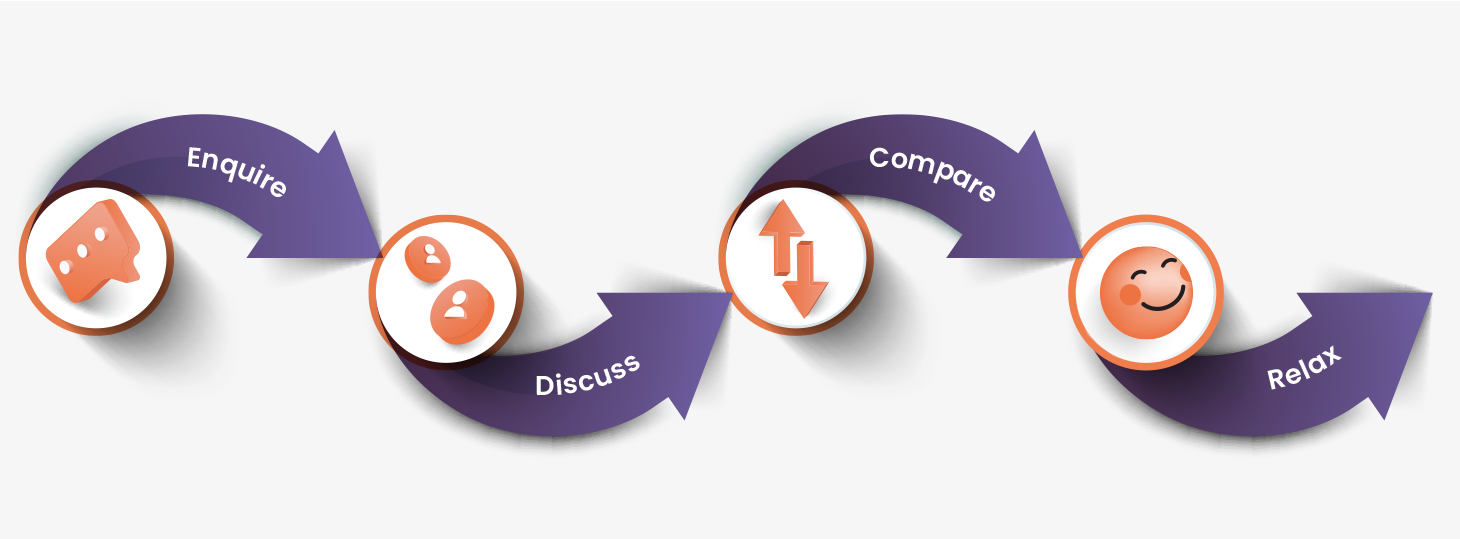

It starts right here...

We love to hear, give us a call, or fill in our contact form so we can see where you are on your mortgages journey. The more details the better!

One of our advisers will get in touch and have a chat about what you’re looking to do, discuss your potential options and answer any questions you may have. At this point we’ll also look at what [...]

We’ll look at different mortgage options, different types of mortgage and discuss which would work best for you.

Sit back and relax, your trusted advisers will help sort everything out, and soon you’ll be in your new home!

The guidance for self employed.

Need more help? →What documents or proof of income do I need to provide?

You will typically need to provide proof of income to demonstrate your repayment capability. This may include tax returns, tax year overviews, business accounts, bank statements, profit and loss statements, contracts or invoices, and proof of identification and address.

How will my self-employed income be assessed for mortgage affordability?

Most lenders: Things lenders will look at are how long you have been trading for, whether you are a sole trader / partnership / Limited company and also how many properties you have – let us work through all this for you.

Are there specific mortgage lenders?

Some lenders are more favourable towards self employed. They understand the unique financial circumstances of self-employed borrowers and have flexible underwriting criteria tailored to their needs. These lenders may consider alternative forms of income verification and have a deeper understanding of the self-employed market.

Book an appointment

Book an appointment Mortgage calculator

Mortgage calculator