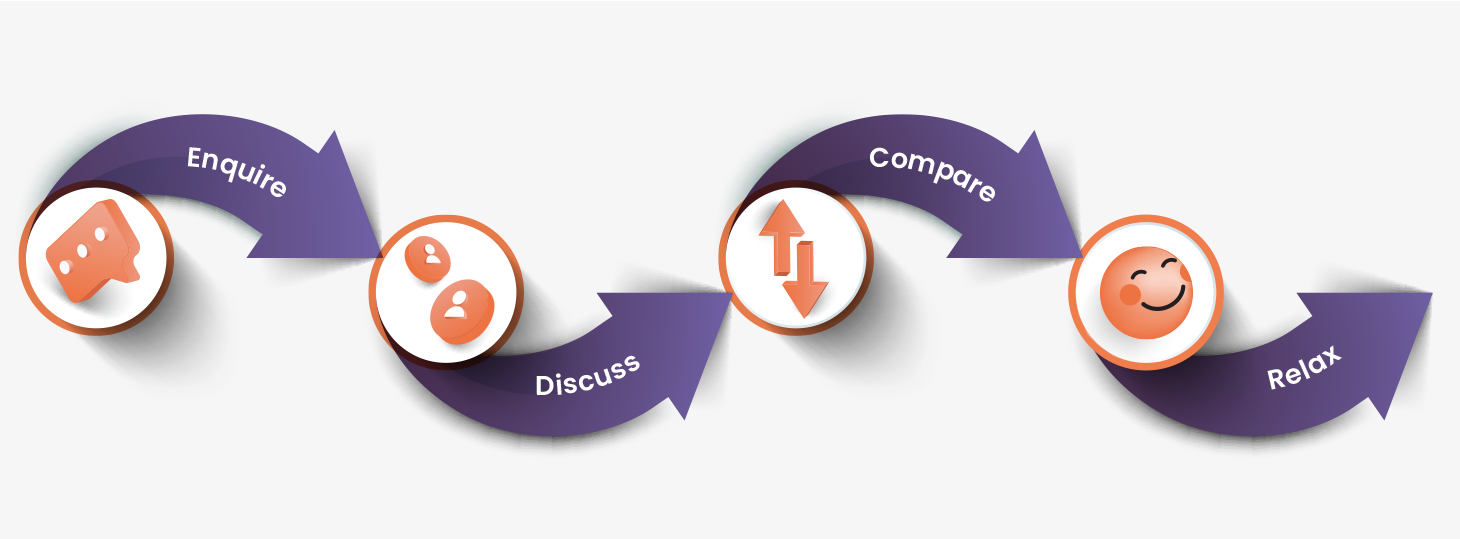

We aim to make understanding and potentially arranging equity release as straightforward as possible:

Access Tax-Free Cash from Your Home with a Trusted Local Broker

Are you aged 55 or over and a homeowner in Derby, Derbyshire, or the surrounding East Midlands? Wondering how you can access the money tied up in your property without having to move? At Mortgage & Finance Arena, your local experts conveniently located opposite Pride Park Stadium, we specialise in Lifetime Mortgages – the most popular and flexible form of equity release.

We provide clear, honest, and FCA-regulated equity release advice tailored to your unique circumstances. Whether you’re looking to boost your retirement income, make essential home improvements, clear existing debts, or help your family financially, we’re here to guide you through your options.

Thinking About Equity Release?

Call our Derby team for a FREE, no-obligation chat

Legal, Survey or EPC Quote

Legal, Survey or EPC Quote Book an appointment

Book an appointment Mortgage calculator

Mortgage calculator