First time buyer

Call our team on: 01332 300 300

Navigating the mortgage maze with ease

We want to make your first mortgage journey a smooth and exciting one! Without the right guidance, the process can be stressful and daunting, that’s why we’re here to help.

With such a massive commitment, we want to make sure you know where your future is heading, keeping you in the loop and on top of your financial status.

Not only will we be able to find the right deal from leading lenders, that is 100% right for you, but we’ll also be able to help you sort the admin and get all those time-consuming forms filled out. That’ll give you the time to enjoy the new home process and save the heavy lifting until move-in day!

Please remember, as a mortgage is secured against your home, it could be repossessed if you do not keep up the mortgage repayments.

Working with thousands of lenders to find the right fit…

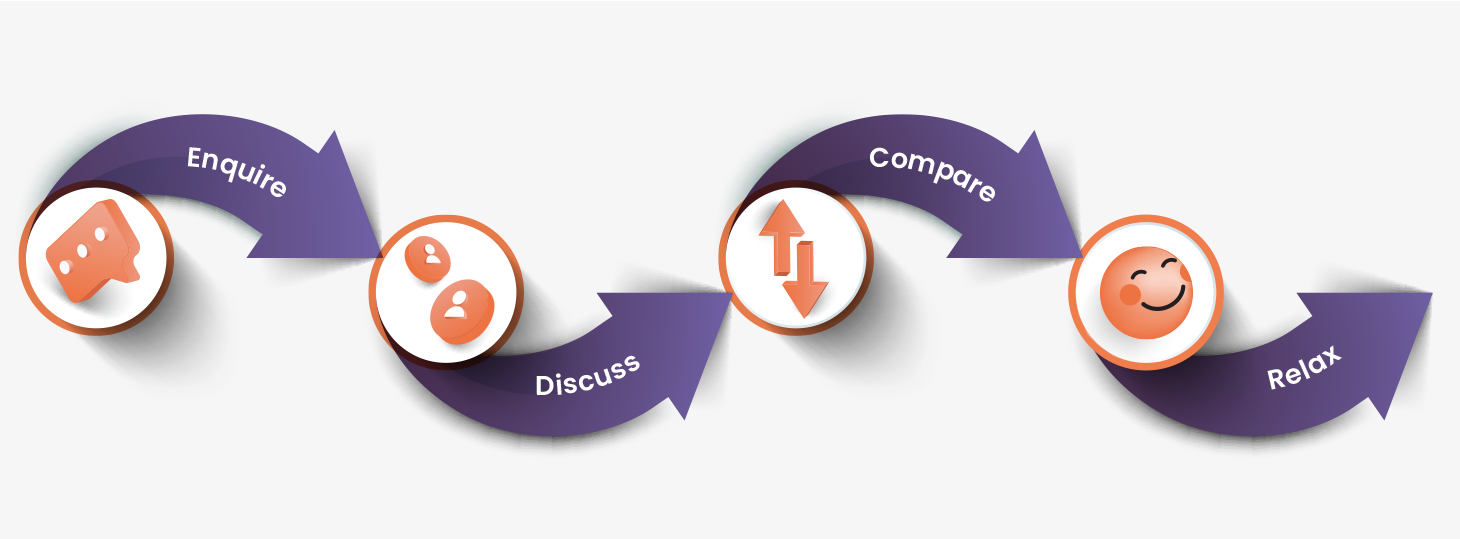

It starts right here…

We love to hear from you, give us a call, or fill in our contact form so we can see where you’re at. The more details the better!

One of our advisers will then find out about what you’re looking to do, discuss your options and answer any questions you may have.

Your adviser will search through thousands of lenders.

Your adviser will find the best option for you and help you arrange things.

The guidance to buying first home.

Need more help? →What Is the minimum down payment required for a mortgage?

Some lenders are offering a 5% deposit although you are likely to get a better interest rate if you can afford to put a bigger deposit down.

What is a help-to-buy scheme and how does it work?

This scheme offers and equity loan where the government lends first time buyers money to purchase a new build home – you need at least 5% deposit.

What additional cost should I be aware of when buying my first home?

Some additional costs in the home buying process can be the cost of valuations, legal fees and in some cases stamp duty.

Book an appointment

Book an appointment Mortgage calculator

Mortgage calculator