Auction Bridging Loan Costs: Typically 0.5% to 2% per month, depending on loan-to-value ratio, property type, your experience and how fast you need completion.

Want a free auction finance calculation?

Fast, flexible bridging finance with competitive rates and quick approvals to help you move forward with confidence.

Need to move fast on a property purchase? We’ve got bridging loans that work around your timeline, not the other way around. Competitive rates and quick decisions for clients across Derby, Derbyshire, the East Midlands, and nationwide.

Based in Derby but we help clients throughout Derbyshire (including Chesterfield, Alfreton, Ripley, Belper, and Matlock), the broader East Midlands, and across the entire UK.

Call our specialists today: 01332 300 300

A bridging loan helps bridge the financial gap between buying a new property and selling your existing one. Think of it as temporary funding until you sort out your long-term finances or your current property sells.

You’d use bridging loans to prevent delays or grab time-sensitive opportunities. They have higher interest rates and need property as security, but they give you quick access to funds when you need to move fast.

Struggling to prove your income the traditional way? We specialise in “non-status” or “self-cert” bridging loans where you don’t need complex income verification.

Perfect if you’re:

Instead of focusing on pay slips and tax returns, our specialist lenders look at:

Here’s how it works: A Derby property developer got £180,000 against his portfolio to buy an auction property, completed in just 8 working days with no income verification needed.

Want to explore non-status options?

Wondering if you’ll qualify? Here’s what lenders actually want to see – and it might be easier than you think.

Property Security

You need a valuable property to secure the loan against. This could be residential, commercial, land, or even a portfolio of properties.

Sufficient Equity

Most lenders want 25-30% equity in your security property, meaning you can typically borrow up to 70-75% of its value.

Clear Exit Strategy

Lenders want to see how you’ll repay the loan. Common ways include:

All bridging loans need property security – that’s just how they work. If you’re after unsecured business funding, have a look at our business cash flow loans instead.

Got an urgent business or financial situation? Our commercial bridging solutions give you the rapid funding you need to keep your business moving forward.

Won the perfect property at auction? Our specialist auction bridging loans make sure you can complete within that tight 28-day deadline.

Traditional mortgages take 4-8 weeks to arrange. Auction purchases must complete in 28 days or you lose your deposit and face legal action. Our auction finance gives you:

Auction Bridging Loan Costs: Typically 0.5% to 2% per month, depending on loan-to-value ratio, property type, your experience and how fast you need completion.

Want a free auction finance calculation?

Get your finance agreed before auction day, often within days

You’ve got guaranteed funding in place

Funds released to your solicitor within the 28-day deadline

Exit via mortgage or property sale when you’re ready

Based out of Melbourne Business Court in Derby, we’re your local finance specialists serving Derby, Derbyshire, and the wider East Midlands.

We can help with:

The main things are having suitable property security and a clear exit strategy. We can often help even if you’ve been declined by high street banks, have poor credit, or complex income.

Yes, these are called “non-status” bridging loans. Specialist lenders focus on your property value and repayment plan rather than traditional income documentation.

Typically £25,000 to £5 million depending on your property equity. Most lenders offer up to 70-75% loan-to-value, with some going to 80% for strong applications.

Most bridging loans complete within 1-3 weeks, much faster than traditional mortgages. For urgent cases with straightforward applications, funds can sometimes be available within 7-10 working days.

Yes, it’s often possible. Many bridging lenders focus more on property security and exit strategy than credit history. We specialise in finding solutions for complex cases.

Absolutely. While we’re proudly Derby-based, we provide bridging finance solutions throughout the entire United Kingdom, with particular expertise across the Midlands.

See how different loan amounts and terms could fit your budget before you apply. Calculate your estimated monthly payments with our mortgage calculator. For more details give our team a call today 01332 300 300.

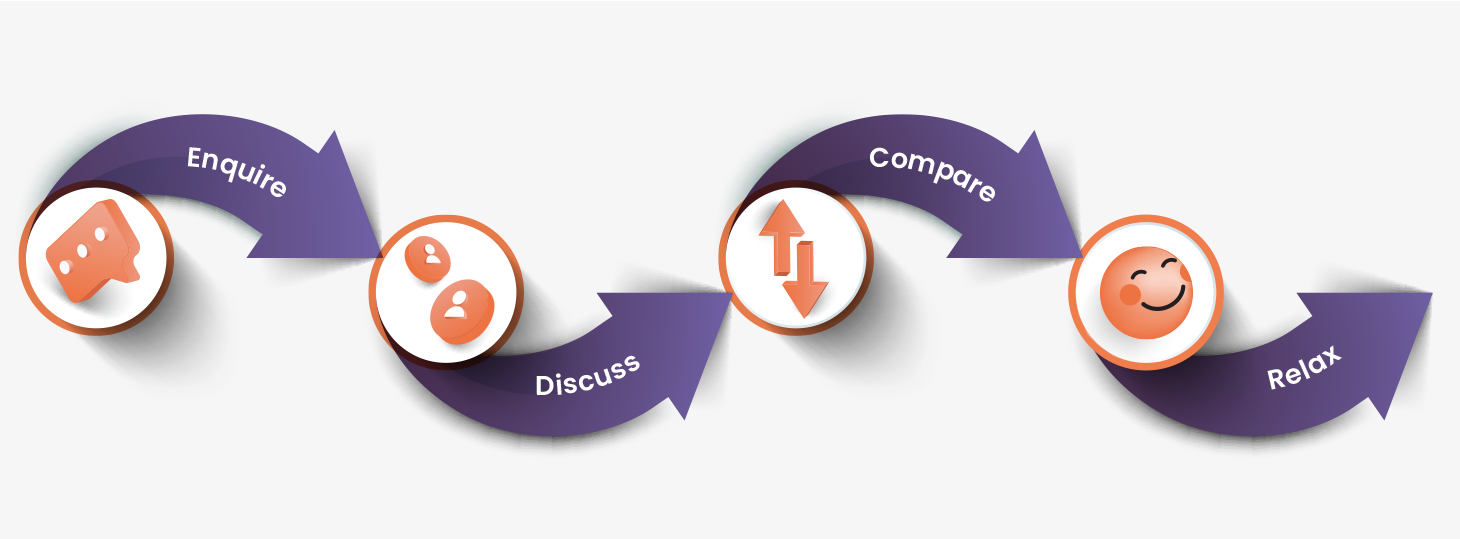

We love to hear from you, give us a call, or fill in our contact form so we can see where you’re at. The more details the better!

One of our advisers will then find out about what you’re looking to do, discuss your options and answer any questions you may have.

Your adviser will search through thousands of lenders.

Your adviser will find the best option for you and help you arrange things.

Property markets move fast. Auction deadlines won’t wait. When opportunity knocks, you need funds that keep up.

Our expert team in Derby is ready to help you get fast, flexible finance, whether you’re in Derbyshire or anywhere else in the UK.

"*" indicates required fields