Moving Home? Your Trusted Mortgage Broker in Derbyshire

Are you planning to move home in Derbyshire? Whether you’re upsizing, downsizing, or relocating for work or lifestyle changes, navigating the mortgage process can be one of the most important—and often stressful—parts of the move. That’s where we come in. As a local, experienced mortgage broker in Derbyshire, we’re here to take the pressure off and guide you every step of the way.

Why Use a Mortgage Broker When Moving Home?

When you’re moving home, you’ll need to secure a mortgage that suits your new circumstances. Unlike going directly to a bank or lender, working with a Derbyshire-based mortgage broker gives you access to a wider range of mortgage products from across the market. This means you’re more likely to find a deal that saves you money and fits your needs, whether you’re selling your current home or porting your existing mortgage.

We help you:

-

Understand your borrowing potential before making an offer

-

Compare hundreds of mortgage deals tailored to your needs

-

Manage paperwork and liaise with lenders on your behalf

-

Stay informed at every stage of the moving and mortgage process

Local Expertise You Can Rely On

As a mortgage adviser in Derbyshire, however we cover the whole of UK , we understand the local property market inside out—from Derby and Chesterfield to Bakewell, Matlock, and surrounding areas. Whether you’re buying a cottage in the Peak District or a modern home in a market town, we can help you make confident decisions with expert, tailored advice.

We also work closely with local estate agents, solicitors, and surveyors to ensure your home move goes smoothly from start to finish.

Ready to Move? Let’s Talk

If you’re moving home in Derbyshire or anywhere in UK and want mortgage advice that’s personal, professional, and completely jargon-free, we’d love to help. Contact us today to book your free initial consultation and see how much you could borrow, what your monthly payments might be, and which lenders are most likely to approve your application.

CLICK HERE TO TO SEE MORTGAGE RATES

Please remember, as a mortgage is secured against your home, it could be repossessed if you do not keep up the mortgage repayments.

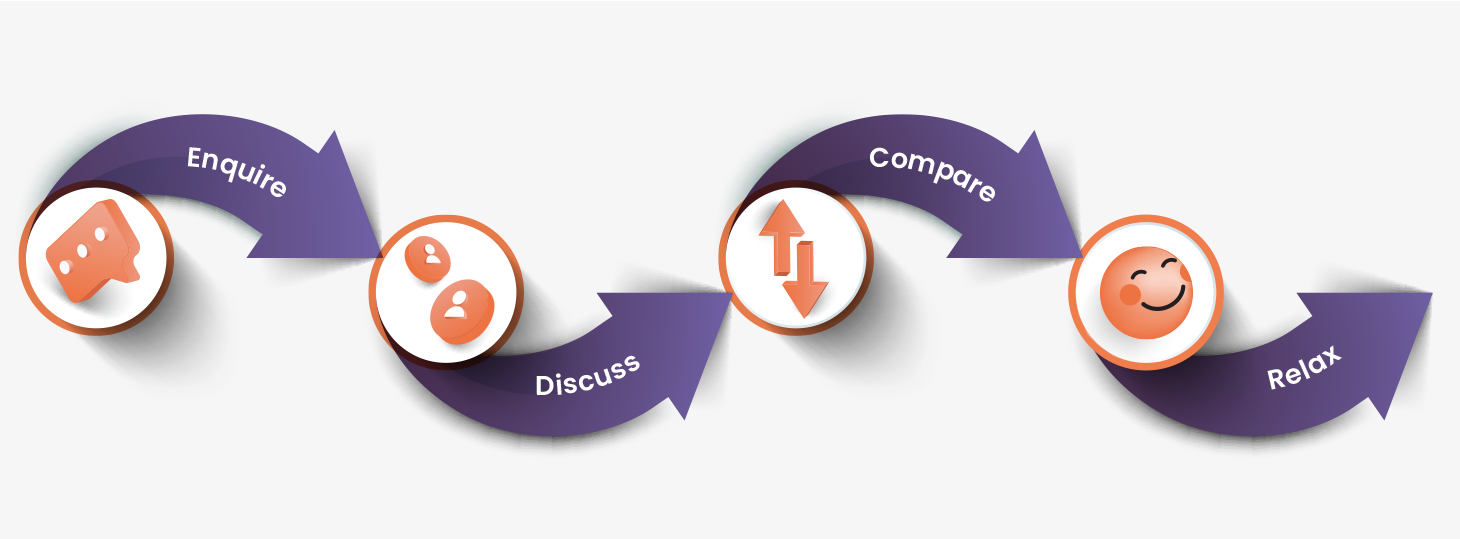

It starts right here…

We love to hear from you, give us a call or fill in our contact form so we can see where you are on your moving home journey. The more details the better!

One of our advisers will get in touch and have a chat about what you’re looking to do, discuss your potential options and answer any questions you may have.

We’ll look at different aspects of your current mortgage, whether this can be ported, get you a better deal, investigate the added costs or start a new mortgage.

Start enjoying your new home and celebrate the beginning of a new chapter.

The guidance to moving home.

Need more help? →What is a home mover mortgage?

This is when you borrow more to enable you to move house, we would review all factors to ensure the new mortgage is suitable for your circumstances.

Can I transfer my current mortgage to the new house?

Yes! In some cases you can do this – we would fully assess your situation to see if this is an option for you.

Can I change my mortgage when I move?

Yes this may be possible depending on your individual circumstances – we will thoroughly review to find the best solution for you.

Book an appointment

Book an appointment Mortgage calculator

Mortgage calculator